It is a common belief that each person has a doppelganger, i.e. a person that looks exactly the same as them. This is the case with two men with the exact same name, which is Brady Feigl. Their paths crossed once they joined the same baseball team, and started realizing their resemblance. Logically, they decided to take a DNA test.

In order to make the reading experience of this article more convenient, the article has been split up into multiple pages. At the end of each page, you will see a “next” button which will take you to the next page. Enjoy your reading!

Getting To Know The First Brady Feigl

Brady Feigl was born and raised in Dallas, Texas, and he grew up developing a natural talent for baseball.

Feigl was an astonishing student with all straight As, but he made sure that his athlete skills are also at an excellent level. His mother was his personal cheerleader since she had always encouraged him to pursue a career path in baseball.

Getting To Know The Other Brady Feigl

The other Brady Feigl was born in the same state but in a different city. However, he spent his childhood in Houston quite similarly to the way the first Brady did. Namely, he loved baseball and kept playing it throughout all of his years as a child.

In his childhood years, he discovered that he was adopted. However, that did not seem like an issue for him since he grew up surrounded by the love of his supportive parents. Nonetheless, he was not such a great student as the first Brady was.

What Did They Have In Common?

Since Houston Brady was adopted, he grew up wondering whether he had other siblings somewhere in the world, and he intended to meet them if that was the case.

Through the love toward baseball, the two Bradys found their way, and their paths crossed. Namely, the strive for baseball was huge in both of them, therefore, they both decided to continue playing baseball after finishing school.

College Days

For their college majors, Brady from Dallas opted for political science, while Brady from Houston chose a major in accounting.

Both Bradys were good students, but they knew from the beginning that the majors in accounting and political science are not the career paths they want for themselves.

Becoming Part Of The Texas Rangers

Both Bradys were talented enough to become members of the Texas Rangers.

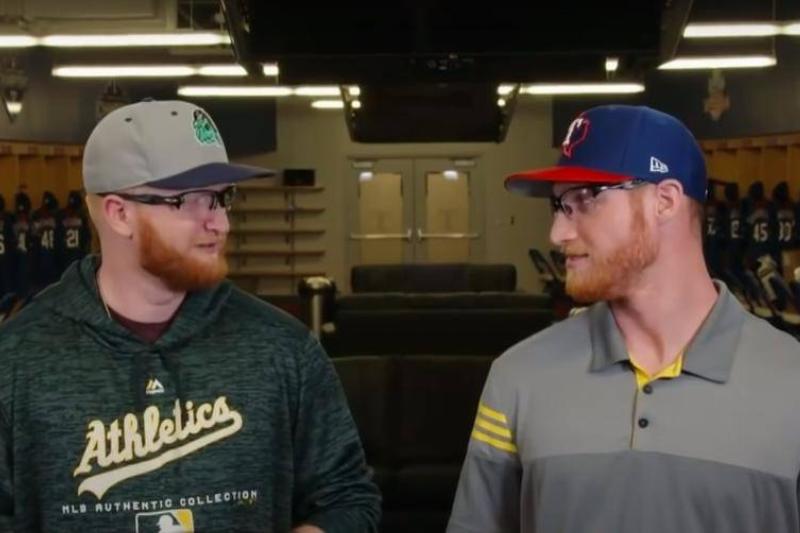

When the whole team got together, everyone was aware that something strange exists between the two guys. Namely, all of the team members including the coach were able to notice the uncanny resemblance between them.

The Coach Did Not Know Who Is Who

When the coach met both of them, he thought the resemblance was funny, and he had quite the laugh of the situation.

However, after they started their training sessions, he realized that this resemblance would be an issue. He could not tell them apart, and there was always a misunderstanding about whom he was addressing.

It Was The Coach’s Idea

Since it was very difficult to tell the two Bradys apart, the coach started thinking about a possible explanation of this occurrence.

Namely, everyone thought that it was just a fascinating coincidence, but something was not entirely right. Therefore, the coach was the first to suggest that they might be somehow related since their resemblance was astonishing.

The Story Of Two Bradys Was Often Compared To One Of The Weasley Twins

If you have seen the Harry Potter series, you are probably aware of what we are talking about.

The red-head twins from Harry Potter that were Ron Weasley’s brothers had a lot of things in common with the two Bradys. Especially the part that Houston Brady was often referred to as the class clown.

The Joke Has Reached Its Limit

At first, everything was funny to everyone. However, after some time the two Bradys were exposed to ridicule the whole time, and that is not what you want in a baseball team.

When the joke goes too far, it results in annoyance and irritation, and that is exactly what happened with the two Bradys. Some players of their team even assumed that they might have the same mother.

The Talk

It was obvious and inevitable that the two Bradys need to sit and talk about this unusual occurrence.

They talked about this notion, and they compared themselves. They acknowledged that there are indeed many similarities between them, such as the height and the fact that both of them wore glasses. Not to mention the talent and the love for baseball. However, they also established that there are still some differences between them.

The Differences

Once they compared themselves thoroughly, they saw that they were not completely identical.

Namely, Brady from Dallas had hazel eyes, while the other one had blue eyes. However, they realized that Brady from Dallas had a mom with blue eyes, and since he was adopted, there was a possibility that they might share some DNA.

The Greatest Similarity

It is quite normal for two people to wear glasses, have the same sense of humor, and be of the same height. However, there were some details in their stories that reach the ultimate realization.

The Bradys realized that they had the same surgical procedure on their elbows. However, that is not the strangest thing. What was even eerier was the fact that the procedure was done by the same doctor.

The Doctor Could Not Connect The Dots

The doctor that performed their surgery was completed it in the dark. He was not aware that there are two people with the same name and the same appearance.

When he needed to talk to Brady from Houston, he ended up calling Brady from Dallas by mistake. That is the moment when Brady received the call and realized that there is a person out there quite similar to him.

The Story Started Spreading Online

The two Bradys told their story on television, and people have gone crazy about them ever since.

People were reaching them out on social media asking many kinds of questions, which was not something quite comfortable for the two guys.

One Step Away From The DNA Test

People were blown away by the idea of two identical people with fascinating stories, so they started going to Rangers games just to see the resemblance with their own eyes.

The fans were so obsessed with the two Bradys that they created a Kickstarter to raise money so the Bradys can take a DNA test.

The Test

The money was raised at a lightning speed, so both of the Bradys were headed towards the first step of their discovery.

They gave their samples for the test and waited patiently for the results.

A Research On Ellis Island

Ellis Island is a place where a lot of immigrants took place in the period between 1892 and 1954.

One of the Bradys went there to learn about his German ancestors. He wanted to learn whether the other Brady had some German ancestors as well.

The DNA Results

Both Bradys were eager to find out the truth about their identical appearance, therefore, they were extremely curious about the results of the DNA test.

The DNA results showed that they have the exact percentage of German ancestry, i.e. 53 percent. After that, they were eager to find out whether they are twins.

Not The Results They Expected

Although many things pointed out that they were twins, the results did not show the same things. Namely, only the German ancestry was the same, however, other things were different in their DNA results.

The two Bradys were not twins after all since the DNA results showed that Brady from Houston was only two percent Irish and Scottish, while Brady from Dallas had 10 percent of these ancestors.

Their Friendship Continued

Both Bradys believed that they were twins, so when the results took place, they were a little bit shocked by them.

They were referred to the names Fred and George because of their resemblance with the Weasley brothers, and the fact that that was the only way to tell them apart.