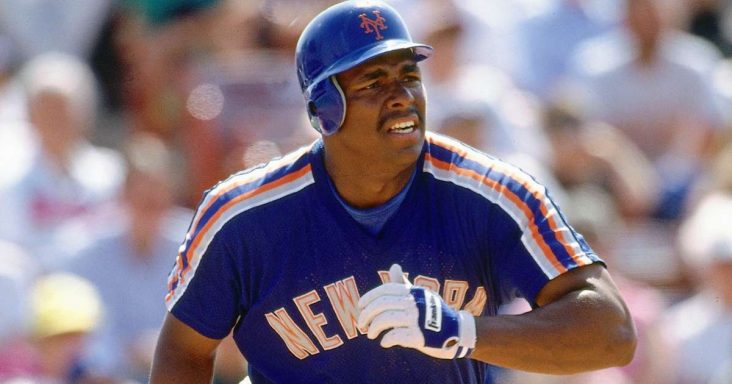

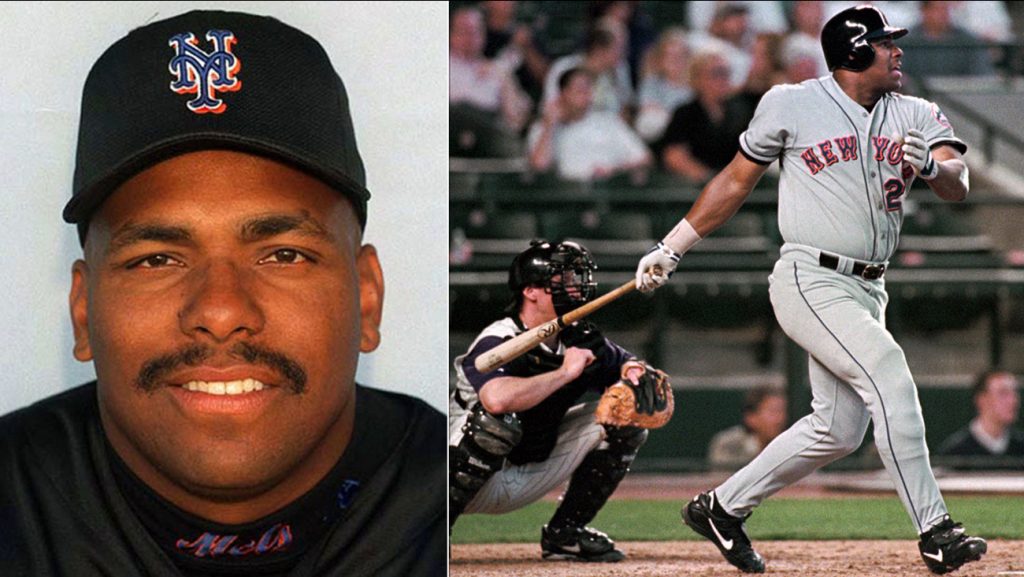

Bobby Bonilla played for 16 seasons in the MLB, racking up stints with teams including the New York Mets, Los Angeles Dodgers, and Florida Marlins. Not many people know this, but did you know that Bobby signed a contract worth $29 million to be paid out over 25 years? Here are 5 more fascinating facts about Bobby!

5. In 2011, the same year Bobby Bonilla received his first check, Wilpon came within a hair of being forced to sell the Mets to a billionaire hedge fund manager named David Einhorn.

In 2011, the same year Bobby Bonilla received his first check, Wilpon came within a hair of being forced to sell the Mets to a billionaire hedge fund manager named David Einhorn.

Einhorn agreed to pay $200 million for a minority stake in the team, with an option to purchase the majority stake at a later date. The deal would have valued the Mets at approximately $1 billion.

However, the deal fell apart at the last minute, and Einhorn backed out. Wilpon was able to keep control of the team, but it was clear that he was in financial trouble.

In 2012, it was revealed that Wilpon and the Mets had invested $550 million with Bernard Madoff, the notorious Ponzi schemer. The Madoff scandal cost Wilpon and the Mets dearly, as they were forced to sell a minority stake in the team to raise cash.

Even though he’s no longer with the Mets, Bobby Bonilla gets paid every year on July 1st. Thanks to a unique contract clause, Bonilla will receive annual payments of $1.19 million from the Mets until 2035!

4. Bobby Bonilla was in the twilight of his career when he was shipped back to the Mets in 1999 after a lackluster season with the Dodgers.

Robert Bonilla had an average career batting average of .279. He also hit 287 home runs while playing in his career. He was born in New York and played for the Mets from 1992-1995. He was traded to the Orioles, signed with the Dodgers, and then later returned to play for the Mets until 2002.

3. Bobby Bonilla will earn $1.2 million from the Mets this year, while Matt will earn $614,000.

Bobby Bonilla’s contract with the Mets is unique. He will earn $1.2 million from the Mets this year, while Matt Harvey will earn $614,000.

The reason for this is that Bonilla deferred his salary when he signed his contract with the Mets in 1999. He agreed to be paid over 25 years, starting in 2011.

This means that the Mets will be paying Bonilla until 2035! He will be 62 years old when his contract finally expires.

In total, Bonilla will earn $29.8 million from the Mets over the life of his contract. This does not include interest or inflation, meaning his total payout could be even higher.

Not bad for a player who hasn’t played for the Mets since 1999!

2. Bobby Bonilla bounced around a bit in the twilight of his career.

Bobby Bonilla is best known for his time with the New York Mets, but he also played for the Pittsburgh Pirates, Florida Marlins, and Baltimore Orioles.

1. In 1991, Bobby Bonilla signed a five-year $29 million contract with the Mets that made him the highest-paid baseball player ever, up to that point.

Bobby Bonilla was born in the Bronx, New York, in 1963. He went to the University of South Alabama and played Major League Baseball from 1986 to 2001. He was a six-time All-Star and won two Silver Slugger Awards. In 1991, he signed a five-year $29 million contract with the Mets, making him the highest-paid baseball player ever at that time.

In 2000, he was traded to the Atlanta Braves and only played 28 games before being released. From there, he played for the Louisville Cardinals before retiring in 2001. Today, since his retirement from baseball Bobby is working as a financial advisor.